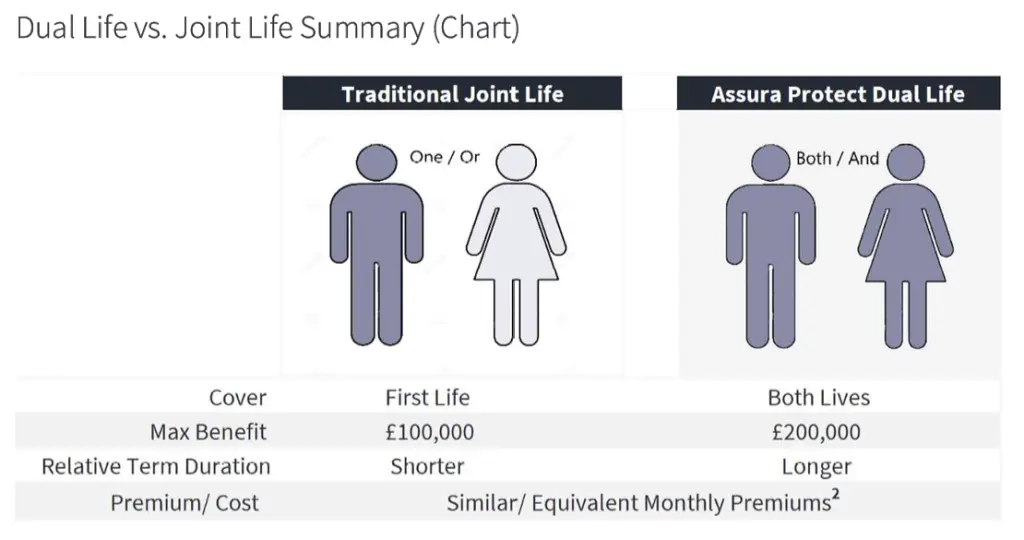

Joint Life cover has been the traditional option when looking for a Life Insurance policy that protects both you and your partner, but the policy ends after the first death. Modern life requires modern Life Insurance solutions though. Introducing Dual Life, part of Dividend Life from Assura + Protect. In this blog, the features and benefits of both traditional Joint Life Insurance and Dual Life Insurance will be compared to help you decide which option better suits your personal needs and circumstances.

What is traditional Joint Life insurance cover?

Traditional Joint Life Insurance cover is a type of Life Insurance policy that covers two people under one policy and pays out a lump sum when the first person dies. This can provide financial security for the surviving partner, but they will then be left without any cover since the policy will end after the first death. This presents a problem that requires a modern solution.

What is Dual Life insurance cover?

Part of Dividend Life from Assura + Protect, Dual Life Insurance cover is a modern Life Insurance policy that provides DOUBLE the level of protection for you and your partner, covers you both separately, and pays out on the death of BOTH policyholders, usually a couple or partners. This means that if one person dies before the other, the protection for the survivor remains in place. Offering up to 200% of the sum assured, this is twice the level of most traditional U.K. Joint Life policies which only provide up to 100% cover.

Discover more about Dividend Life with 200% Multi-Claim Critical Illness cover and 200% Dual Life cover by watching the video below.

Comparing Traditional Joint Life cover and Dual Life cover

Traditional Joint Life cover can be useful if you and your partner have shared financial commitments, such as a mortgage, debts, or children. The lump sum payment that a Joint Life policy provides can provide funds to help the surviving partner pay off any outstanding debts, cover living expenses, or support the children. Despite these advantages, traditional Joint Life cover also has some drawbacks, such as:

+ It only pays out once, and only covers the first death. If you or your partner both die at the same time, or the second person dies soon after, the policy will not pay out again leaving any dependants without any financial support.

+ Since a traditional Joint Life policy only pays out once, you might end up paying more for the policy than you or your partner receives in return.

+ Multiple claims for different major critical illness conditions are not allowed. If you and your partner become critically ill, and your Joint Life policy includes critical illness cover, the policy will not pay out more than once. This means you would not receive any financial help to cope with medical expenses, loss of income, or lifestyle changes caused by the critical illness.

Dual Life cover from Assura + Protect can be beneficial if you and your partner would like to have more protection and peace of mind for yourselves and your loved ones. It can provide advantages over traditional Joint Life cover, such as:

+ It pays out on both deaths, not just the first. If you or your partner die, protection remains in place for the survivor. If both you and your partner die at the same time, or one of you dies after the other, the policy will pay out twice, providing more financial support for your dependants.

+ It allows multiple claims for different critical illness conditions. If one of you becomes critically ill, the policy will pay out up to 200% of the sum assured, regardless of whether the illness is terminal or not. This can provide financial assistance with the medical expenses, loss of income, or lifestyle changes caused by the critical illness. Each policyholder can claim for up to 3 major critical illness conditions up to a maximum of 200% of the total sum assured.

+ It offers more value for money and similar premiums to traditional Joint Life cover, offering a greater level of cover and life empowering benefits. The cost of the policy also depends on several factors such as the age, health, lifestyle, and occupation of you and your partner, as well as the amount and duration of cover. Since a Dual Life policy pays out more and allows a greater number of unrelated claims for major critical illness conditions, it offers greater value for money than a traditional Joint Life policy.

+ It offers more flexibility and control for policyholders as different options. With Dual Life cover, you can nominate separate beneficiaries for each benefit payment making estate and inheritance planning easier. You can also enjoy additional benefits, such as 24/7/365 GP consultation services via Doctor-on-Demand, and life empowered membership benefits which give you discounts and rewards from over 300 retail partners across Grocery, Tech, Travel and much more.

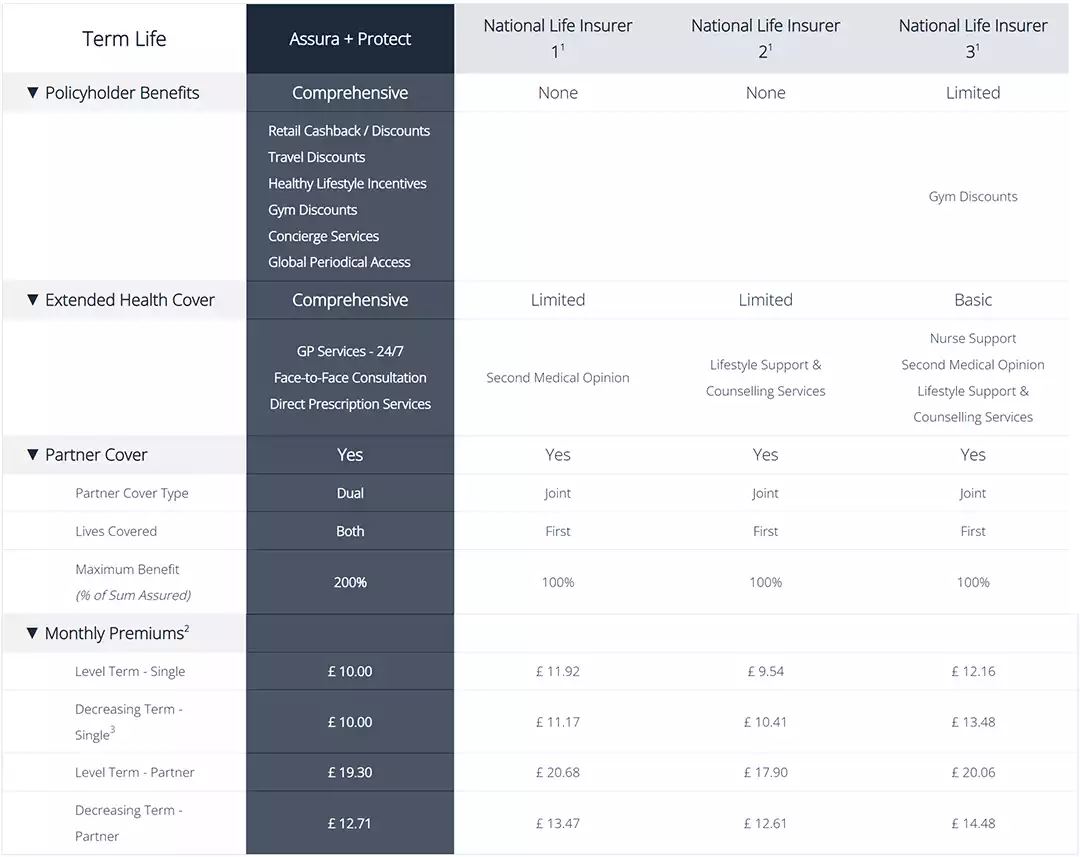

Look at the Partner Cover section in the table below to see how Dual Life compares with traditional Joint Life cover policies offered by other national life insurers.

Concluding, traditional Joint Life cover and Dual Life cover are two types of Life Insurance policies that can protect you and your partner in case of death or critical illness. However, they have some key differences that you should consider before choosing one option over the other.

Take advantage of the superior features and benefits that Dual Life policies from Assura + Protect offer both you and your partner. See how Dividend Life Cover, Benefits & Premiums compare to national U.K. life insurers and get a complimentary quote.