Term Life Insurance

Modern Life Insurance with:

Up to 200% Multi-Claim Critical Illness Cover

200% Dual Life Cover

Life Empowered Membership Benefits

What is Term Life Insurance?

Benefit payments are tax free and can be used for any purpose.

Traditionally, Term Life has been designed to provide financial protection towards:

Ensuring a standard of living for your dependents, such as continued living costs, school costs and university costs.

Paying off outstanding mortgages or loans.

Covering funeral costs.

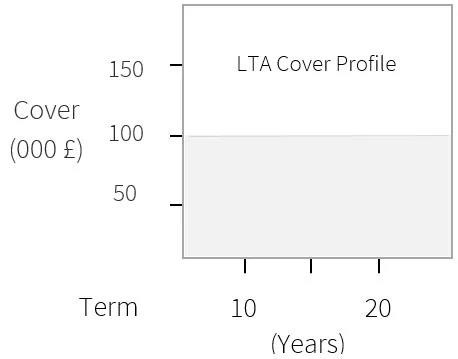

Level Term Assurance (LTA)

Level term life insurance is where the premiums and amount of cover stay the same during a policy term, regardless of when the insured person passes away. Simplistically, the amount of cover is ‘level’ and constant.

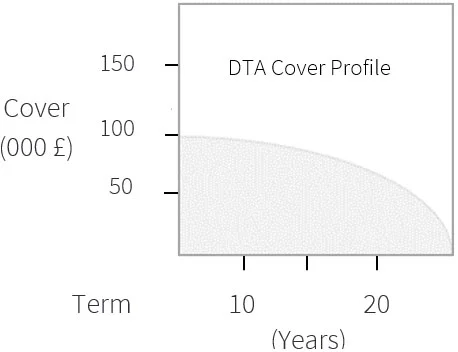

Decreasing Term Assurance (DTA)

Also known as mortgage life insurance, means your cash sum assured decreases in a similar fashion to the way a repayment of a mortgage decreases the outstanding mortgage amount. Like Level Term, the premiums are fixed but tend to be lower due to the fact the amount of cover reduces over time.

Assura Dividend Term Life

Cover & Eligibility

For both Level Term and Decreasing Term policies the maximum amount of protection that can be purchased is up to a value of £1,000,000, and your specific amount of cover may vary based on your age, health, and our underwriting criteria.

The maximum term for a Dividend Life Policy is 50 years.

Included with your Assura Policy

Additional Policy Options

Premiums & Policy Costs

Full Annabel Benefits & Rewards included on policies at no additional cost.