For many people, marriage is one of life’s most significant milestones, bringing with it new shared responsibilities and dreams. However, as a married couple, you’re not just planning a future together; you’re also thinking about how best to protect each other financially in case life takes an unexpected turn. One of the most important decisions you’ll make in this regard is selecting the right life insurance policy. But with so many options to choose from, how do you pick the best one?

As a couple, the biggest question you’ll likely be faced with is what kind of policy you should take out. While you’ve probably heard of traditional single and joint life insurance policies, you may not know about Assura Protect’s Dual Life Cover, which offers a number of significant benefits over the former two options. In this blog, we’ll take a look at why Dual Life Cover is a good choice for married couples, along with the benefits of combining life insurance and critical illness cover.

What are the Different Types of Life Insurance Policy?

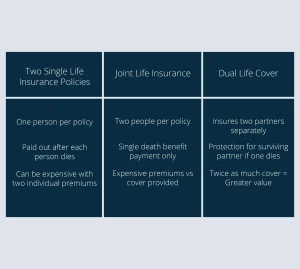

If you’re new to the world of life insurance, you might be wondering what the differences are between single life insurance, standard joint life insurance and Dual Life Cover to determine which policy is the right choice for you.

Single Life Insurance

A single life insurance policy covers one person only and pays out the chosen amount of cover if that person dies during the length of the policy. If a couple holds two single policies and one partner dies, then the surviving partner will still have their own policy.

Joint Life Insurance

A joint life insurance policy covers two lives, and operates on a ‘first death’ basis. This means that the chosen amount of cover is paid out if the first person passes away during the length of the policy, after which the policy ends. The policy only pays out once, which ultimately leaves the surviving partner without cover.

Dual Life Cover

Dual Life Cover is a type of life insurance policy that insures both partners individually under the same policy. Unlike a joint life insurance policy, which only pays out once, usually on the death of the first partner, Dual Life Cover provides two separate payouts – one for each partner.

This structure means that if one partner passes away, the surviving spouse still has their own life insurance policy intact, granting them financial security well into the future. This distinction is crucial, especially when considering the long-term needs of your family.

Why Dual Life Cover is a Great Choice for Married Couples?

Now that we’ve covered the differences between different types of life insurance, let’s take a look at what makes Dual Life Cover an excellent choice for married couples.

1. Double the Protection

The biggest, most obvious, advantage of Dual Life Cover is the double payout. As mentioned above, in a joint life insurance policy, there’s only one payout – usually upon the death of the first policyholder. After that, the surviving partner is left without cover unless they take out a new policy, which could be more expensive and harder to apply for due to age or health conditions.

With Dual Life Cover, each spouse has an individual payout. If the worst were to happen and both partners were to pass away, there would be two separate payouts, which would result in more financial support for your dependents. This is particularly important if you have children or other financial obligations that would need to be addressed in you and your partner’s sudden absence.

2. Continued Cover After the First Payout

In a joint life insurance policy, the cover ends after the first payout, leaving the surviving spouse without protection. However, this is not the case with Dual Life Cover. If one partner dies, the surviving partner’s policy remains active, meaning that they still have life cover without needing to go through the process of purchasing a new policy. Continued protection is especially useful if the surviving spouse needs time to adjust financially or emotionally before making any more decisions about their life insurance needs.

3. Flexibility in Premiums and Coverage

Dual Life Cover also offers more flexibility compared to joint life insurance policies. With Dual Life Cover, each spouse can tailor their coverage and premiums to their specific needs and circumstances. For example, if one partner has a higher income or greater financial responsibilities, they might opt for a higher level of cover. Flexibility in your policy means that both partners are sufficiently protected according to their individual needs, without having to compromise on a one-size-fits-all approach that a joint policy might necessitate.

4. Better Value for Money

While Dual Life Cover might initially seem more expensive than a joint policy, it often provides better value for money in the long term. Given that it offers two payouts, the overall financial benefit is greater, particularly if both partners were to pass away. On top of this, since the surviving partner does not need to purchase new cover, there are also potential cost savings in the long run. When considering the rising costs of life insurance as you age, having a policy that continues without interruption can save a significant amount of money over time.

Premium Life Insurance and Critical Illness Cover

As a married couple, one of the best steps you can take to secure your future is to choose a life insurance policy that offers robust, flexible and comprehensive protection. Dual Life Cover from Assura Protect gives you the security of knowing that both you and your spouse are covered, no matter what the future holds.

Not only does Dual Life Cover provide double the protection, but it also guarantees that you’re not left vulnerable after the first payout, offers flexibility in coverage and premiums and can be combined with critical illness cover for even greater peace of mind.

Whether you’re looking to combine life insurance with critical illness cover or simply want to explore your options, we’re here to provide you with the expert advice and support you need. For more information about our policies, please get in touch.