In this blog, we introduce the Dividend Term Life & Critical Illness Multi-Claim Benefit Calculator from Assura + Protect. You will learn what it is, the benefits of using it, how to use it step by step, and how to review your results. You will also be presented with different benefit payout examples for consideration before getting a complimentary quick quote for Better Cover, Longer, including Life Insurance with up to 200% Multi-Claim Critical Illness and Dual Life cover.

What is the Dividend Term Life & Critical Illness Multi-Claim Benefit Calculator?

The Dividend Term Life & Critical Illness Multi-Claim Benefit Calculator from Assura + Protect is a tool that provides a simple and easy way to help you calculate the level of protection you need, depending upon your personal circumstances, and estimates the potential benefits and total cover available for Assura + Protect’s market-leading Dividend Life product so you can make an informed decision about protecting your family and income. It allows you to select your level of protection and policy sum assured, choose different conditions and claims scenarios, and review potential benefits and total cover available.

Illustrations are provided for Assura + Protect’s market-leading Dividend Life product, a modern Term Life and Multi-Claim Critical Illness insurance policy offering Better Cover, Longer, providing up to 200% Multi-Claim Critical Illness and Dual Life Protection. A Dividend Life policy also includes Doctor-on-Demand offering 24/7/365 virtual-based GP consultations at a time that suit you from anywhere in the world, and Life Empowered Membership Benefits with Annabel Rewards. Premiums are fixed for the entire policy term unless you choose to change cover and there are no additional costs to receive full Membership Benefits and Annabel Rewards.

Available to U.K. residents aged between 18 and 70, you can apply for a Dividend Life policy by visiting https://www.assuraprotect.com/robo-advisor/ and using Annabel, Assura + Protect’s Robo Advisor and your digital insurance partner, after having used the Dividend Term Life & Critical Illness Multi-Claim Benefit Calculator to determine the level of cover you require.

Annabel will ask you to provide some personal details and then you will be asked to answer some health-related questions. Once your answers have been submitted, you will receive a Life + Empowered Demands & Needs Life Cover Review Assessment Report detailing your coverage requirements and quotation details. Shortly after, you will be contacted by one of Assura + Protect’s Life Protection Consultants to help you secure your Life Empowering Dividend Life policy with up to 200% Multi-Claim Critical Illness and Dual Life cover.

Benefits of using the Dividend Term Life & Critical Illness Multi-Claim Benefit Calculator

Using the Dividend Term Life & Critical Illness Multi-Claim Benefit Calculator you will be able to:

+ Use a complex algorithm to provide accurate estimates of how much coverage you require.

+ Calculate a personalised estimate of how much of coverage you and your family need based on your financial situation and goals.

+ Compare the difference between traditional Term Life or Critical Illness cover and Assura + Protect’s Dividend Life with Multi-Claim Critical Illness cover offering up to 200% of the initial sum assured for major condition claims and additional partial covers that do not count towards the maximum benefit.

+ Review the level of protection Assura + Protect’s Dual Life cover provides for both you and your partner.

+ Explore the several policyholder benefits that are included with a Dividend Life policy, such as cashback from over 300 retail partners, travel discounts, gym discounts, your very own personal concierge services, access to leading global periodicals, and access to 24/7/365 GP consultation services via Doctor-on-Demand.

How to use the Dividend Term Life & Critical Illness Multi-Claim Benefit Calculator

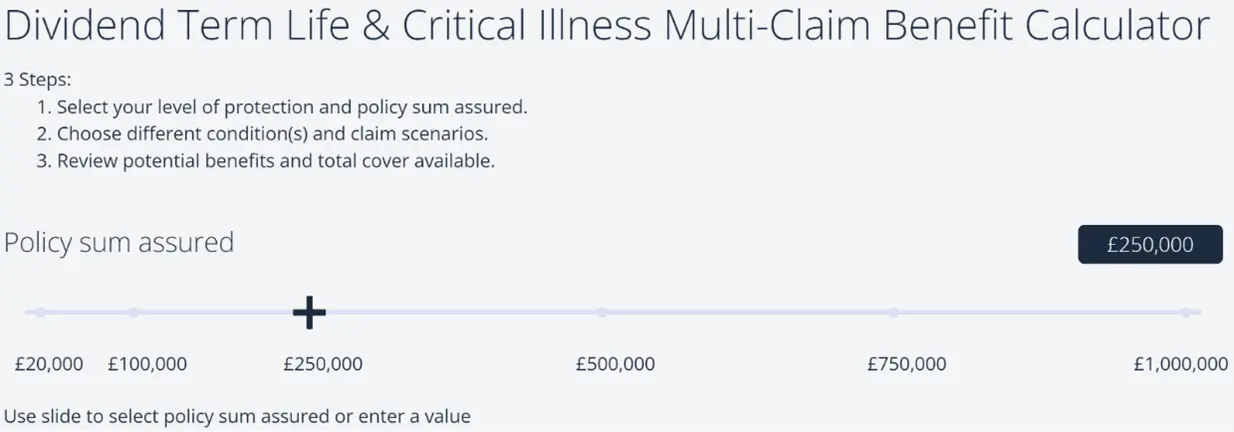

To use the Dividend Term Life & Critical Illness Multi-Claim Benefit Calculator, perform the following steps:

Step 1

Drag the slider to select the level of Critical Illness protection and policy sum assured that you would like. You can choose an amount of cover between £20,000 and £1,000,000. The policy sum assured affects the total cover available, in addition to the premiums that you will pay.

Your Dividend Life policy can be Level Term or Decreasing Term. Level Term means that the policy sum assured and the premiums remain the same throughout the policy term. Decreasing Term means that the policy sum assured decreases over time, usually in line with a mortgage or loan.

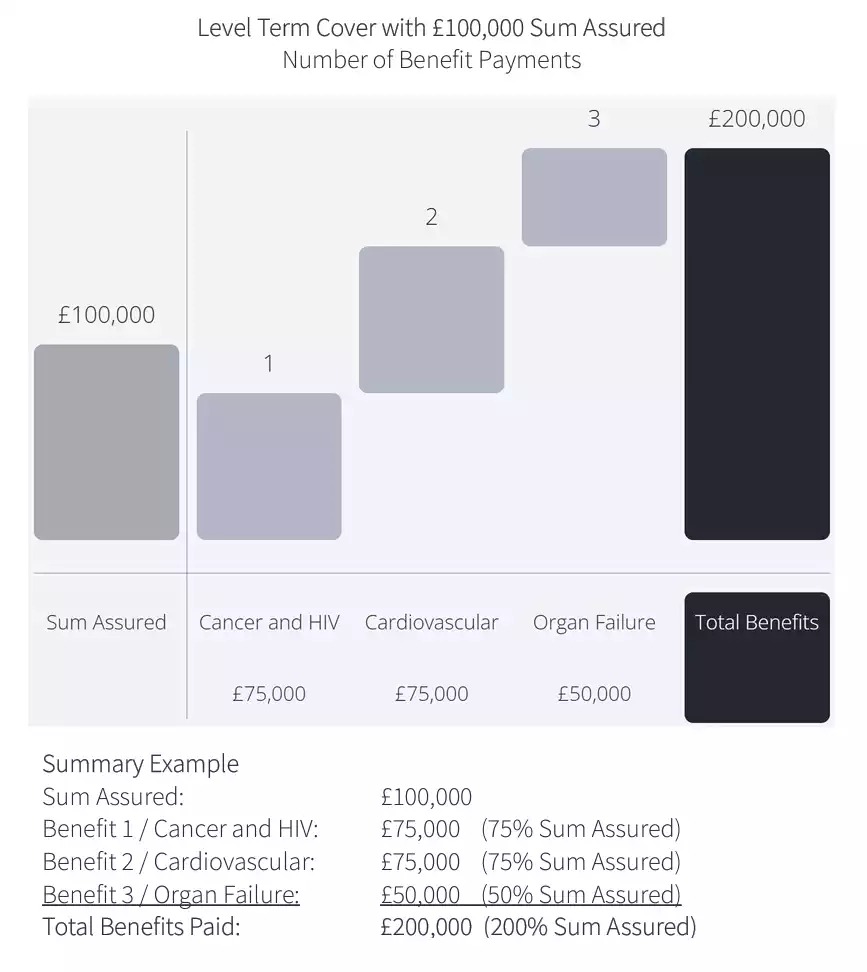

Step 2

Add the Critical Illness condition(s) and claim scenarios that you would like to be covered for. You can select up to three major conditions, 1 partial cancer condition, up to 3 additional covers, and either death or related death cover.

Major conditions are serious illnesses such as cancer, a heart attack, or a stroke. Partial cancer is less severe form of cancer that includes conditions like carcinoma in the breast, prostate cancer, and thyroid cancer. Additional covers are minor illnesses or injuries such as broken bones, burns, or diabetes. Death or related death means that the policy pays out if you pass away or if you pass away from a previously claimed major condition.

Step 3

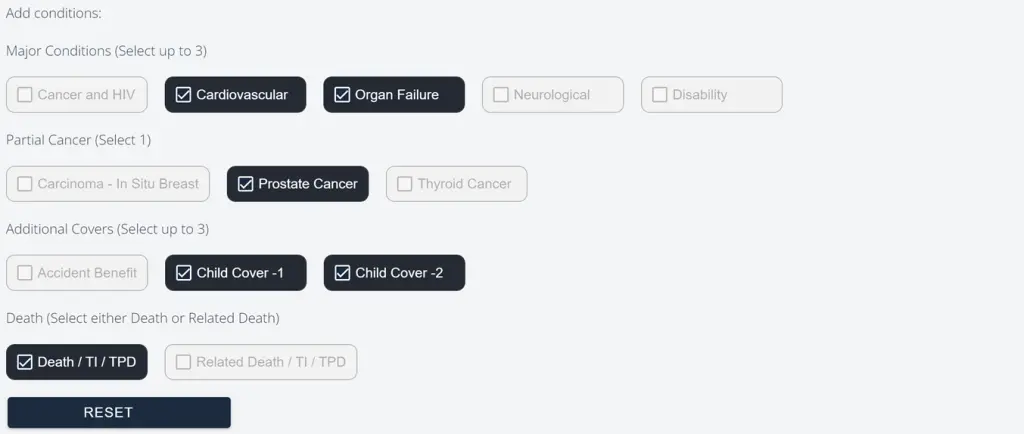

The Dividend Term Life & Critical Illness Multi-Claim Benefit Calculator will show you the potential benefits and the total cover available for each condition and claim scenario that you selected.

How to review your results from the Dividend Term Life & Critical Illness Multi-Claim Benefit Calculator

The results of the Assura + Protect Dividend Term Life & Critical Illness Multi-Claim Benefit Calculator show you how much benefit you can receive from the policy, depending on the level of protection, policy sum assured, and different conditions and claim scenarios you choose.

The potential benefits are the amounts of money that the policy will pay out if you make up to three claims for different major conditions, with a maximum of one claim per each of the major conditions categories cited in our Terms & Conditions. The total cover available is the maximum amount of money that the policy will pay out in total, this being up to 200% of the policy sum assured which means you can receive twice as much cover as the amount of cover for a similar price to traditional single claim policies. As highlighted above, it is possible to receive over 200% of the policy sum assured in some cases.

Make sure that you compare the results provided by our Dividend Term Life & Critical Illness Multi-Claim Benefit Calculator with those from national life insurance providers offering traditional term life and critical illness cover, only paying out once and only covering death or critical illness. The comparison of Dividend Life Cover, Benefits & Premiums to national U.K. life insurers providing traditional life or critical illness cover will show you how your Dividend Life policy offers more advantages and features than traditional life cover, such as:

+ More cover for both you and your partner.

Dual Life, included within your Dividend Life policy, ensures that each partner is covered separately, and pays out a benefit on both deaths, not just the first. This means that once one partner passes away, the protection will remain in place, and your dependants will receive more financial support when both you and your partner have passed.

+ More claims for different critical illness conditions.

Your Dividend Life policy includes a multi-claim element allowing you multiple claims – up to 3 – for different major critical illness conditions, with a maximum of one claim per each of the major conditions categories cited in our Terms & Conditions. This means you will receive financial support to cope with the medical expenses, loss of income, or lifestyle changes caused by the illness.

+ More value for money and similar premiums as traditional life cover.

Your Dividend Life policy offers a greater amount of cover with more claims for a similar (or lower in some cases) price compared to traditional life cover, depending on the amount and type of cover you choose.

+ More flexibility and convenience.

These are the steps to use the Dividend Term Life & Critical Illness Multi-Claim Benefit Calculator from Assura + Protect. Using the calculator will help you explore the different options and scenarios to see how a Dividend Life policy can provide you and your partner with more protection and peace of mind knowing that your dependants will be supported once you have passed away.

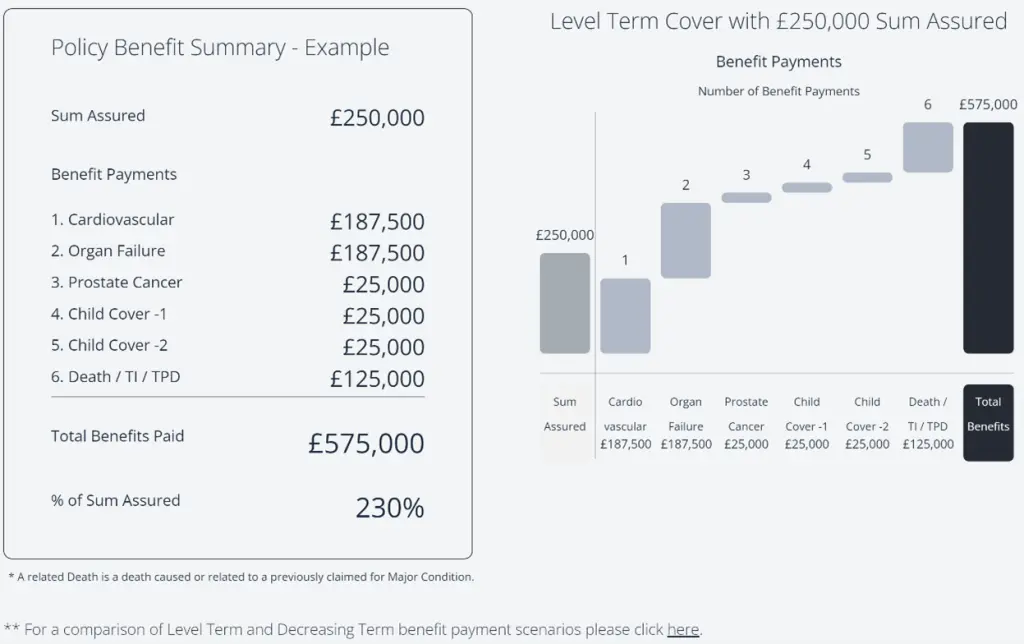

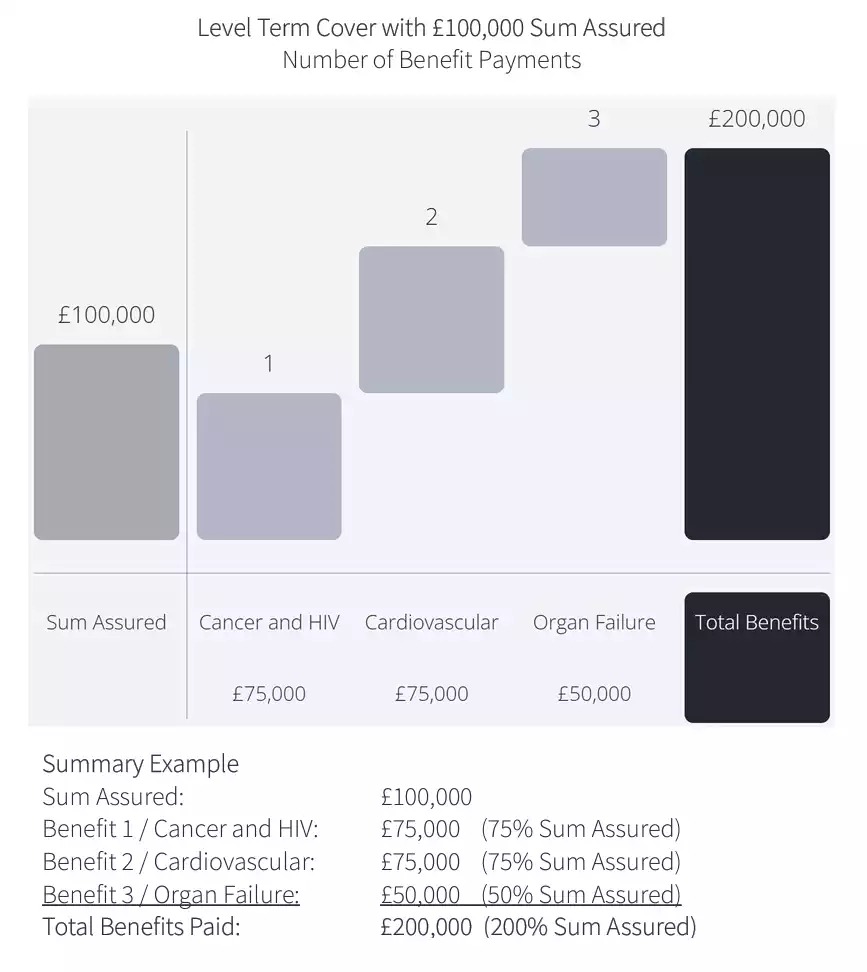

Review the example illustrations below highlighting different benefit payout examples based upon different claim scenarios.

Multi-Claim Benefit Payout Examples

The following chart and results from the Dividend Term Life & Critical Illness Multi-Claim Benefit Calculator illustrate how a Dividend Life policy will pay out should you suffer three unrelated critical illnesses over the term of the policy.

The following chart illustrates how a Dividend Life policy will pay out should you suffer two unrelated critical illnesses over the term of the policy.

Conclusion

Concluding, the Dividend Term Life and Critical Illness Multi-Claim Benefit Calculator is a extremely useful tool for anyone looking to make an informed decision regarding the best way to protect their family and income after they have passed away. By using it, you can easily calculate the level of protection you need and discover the life empowering benefits, rewards and total cover that you can gain from purchasing a Dividend Life policy.

See how Dividend Life Cover, Benefits & Premiums compare to national U.K. life insurers and get a complimentary quote.